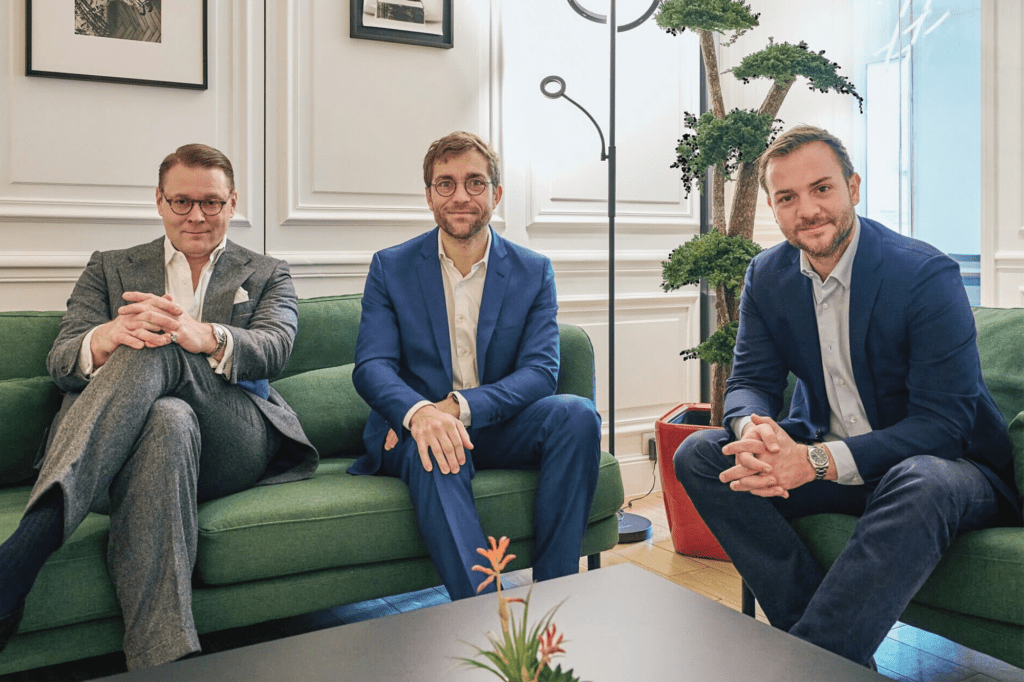

Clipperton is pleased to announce that Dr. Nikolas Westphal, Antoine Ganancia, and Thomas de Montille have been promoted to Managing Partner, marking a significant milestone in its organizational structure.

Since 2003, Clipperton has remained dedicated to assisting its clients throughout their expansion endeavors, resulting in the company expanding its workforce to approximately 50 employees spanning across France and Germany. Antoine Ganancia and Thomas de Montille, who have been integral parts of Clipperton for over a decade, showcase the enduring strength and stability of the firm’s senior leadership. Alongside them, Dr. Nikolas Westphal, having assumed the role of Partner in 2020 in Berlin, contributes a significant wealth of expertise and strategic acumen to his recent promotion. These promotions are positioned to not only drive greater engagement, establish strategic partnerships, and enhance visibility within Europe, but also to harmonize with Clipperton’s path toward enduring success and significant expansion.

Nicolas von Bülow, Co-Founder, and Thibaut Revel, Managing Partner at Clipperton, commented:

“Welcoming Antoine and Thomas to our managing partnership celebrates their impressive 13 and 10-year tenures, showcasing our team’s stability and deep sector-specific know-how. With their addition, we reinforce our position as a premier tech investment bank, focusing on empowering high-growth technology companies across Europe. Their expertise further enhances our team at Clipperton, highlighting our dedication to nurturing lasting connections within our ecosystem.

Nikolas’ appointment as Managing Partner is not only a recognition of his exceptional leadership but also marks a significant milestone for Clipperton in establishing its first-ever Managing Partner position in Germany. This strategic decision aims to leverage Nikolas’ proficiency to lead efforts in enhancing Clipperton’s presence in the dynamic DACH market.”

Dr. Nikolas Westphal joined Clipperton as a Partner, acts as Head of Germany, and is responsible for the acceleration and expansion of Clipperton’s footprint in Germany and German-speaking countries (DACH) since 2020.

Dr. Nikolas Westphal joined Clipperton as a Partner, acts as Head of Germany, and is responsible for the acceleration and expansion of Clipperton’s footprint in Germany and German-speaking countries (DACH) since 2020.

At Clipperton, Nikolas has been involved in several landmark M&A deals such as gridscale (sale to OVHcloud), Smartlook (sale to Cisco), Dan.com (sale to GoDaddy), Eijsink (sale to Metro), 8fit (sale to Withings), or Packlink (sale to Thoma Bravo’s portfolio company Auctane).

Before joining Clipperton, Nikolas served at Morgan Stanley, Arma Partners, and GP Bullhound. Throughout his career to date, his experience has included marketing, structuring, and executing a broad set of transactions, including M&A sell/buy-side advisory, debt and equity recapitalizations (including private placements and public offerings), and other strategic M&A and capital advisory services.

Nikolas graduated from Leipzig Graduate School of Management (HHL) and holds a Doctorate of Economics (Magna Cum Laude).

Antoine Ganancia joined Clipperton in 2010, where he was involved in over 80 transactions with a particular focus on Health Tech, SaaS, and consumer application businesses.

Antoine has actively participated in numerous significant transactions, both M&A deals and Private Equity financings for leading tech businesses across Europe. His key transactions include Braincube’s recent $90M round with Scottish Equity Partners, DentalMonitoring’s $150m growth financing with Merieux Equity and Vitruvian, Inova’s $70m investment by Carlyle, the sale of Fruitz to Bumble [NASDAQ: BMBL], the fundraising of $60m of Withings with Gilde Healthcare and Eurazeo, or Brevo’s $160m round by Bridgepoint, Bpifrance and Blackrock.

He began his career at Mars & Co., where he participated in various projects for Fortune 500 clients in the Consumer Electronics industry. He then worked at Apple EMEA Headquarters in London.

Antoine is an HEC alumnus and holds a Master’s in Digital Business Strategy from Telecom Paris (ENST) and HEC Paris.

Thomas de Montille joined Clipperton in 2013 and focuses on travel tech, B2B services, and consumer businesses.

Over the years Thomas advised numerous technology leaders on the sell-side in M&A transactions and Private Equity financings, including notably Wikiloc (investment from Miura Partners), Gymlib (sold to EGYM), Click&Boat (investment from Permira and Boats Group), Musement (sold to TUI Group), Aramisauto (sold to Stellantis) or Odoo (Series B and C rounds). He also assisted a number of high profile Private Equity funds on the buy-side including recently Astorg ($500m investment in EcoVadis) and Capza (investment in Travelsoft).

Before joining Clipperton, Thomas spent over four years with Jefferies as part of the Technology Investment Banking team based in London.

Thomas graduated from EDHEC business school and holds an MSC in finance.

You can reach Nikolas via nwestphal@clipperton.com, Antoine via aganancia@clippperton.com, and Thomas via tdemontille@clipperton.com.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory services to entrepreneurs, corporates, and top-tier investors in Europe who are willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, and London, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology startups, blue-chip corporates, and renowned financial investors.