Clipperton acted as sole sell-side financial advisor to Fruitz, its management and shareholders on its sale to Bumble Inc. [NASDAQ: BMBL], a leading online dating application. This transaction, which is Bumble’s 1st acquisition, is further testament to Clipperton’s strong track record in the consumer apps and consumer subscription space.

Executive Summary

- Clipperton acted as sole sell-side financial advisor to Fruitz, its management and shareholders in this transaction, which is the first acquisition of Bumble.

- This deal confirms Clipperton expertise in the consumer subscription industry after successfully advising on the sale of 8fit to Withings and advising a leading mindfulness platform on its sizable financing round by several family offices.

- It is one of the most significant M&A transactions in online dating in Europe.

Our Client

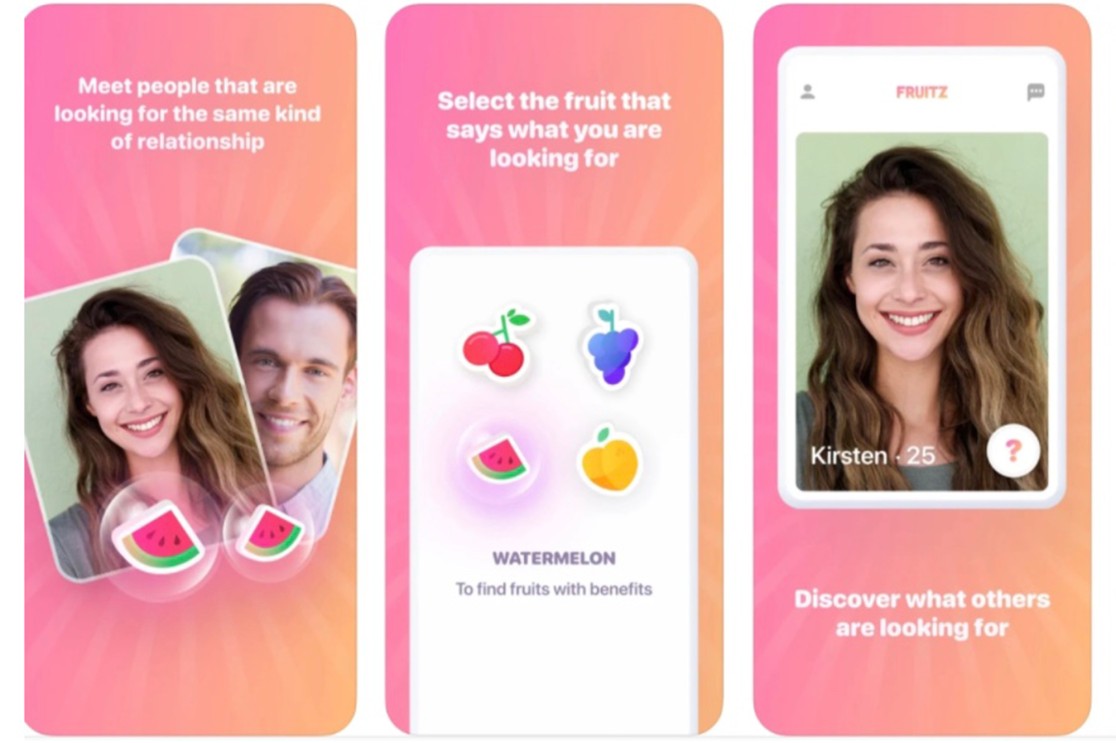

- Fruitz was co-founded by Julian Kabab, Fabrice Bascoulergue and Arnaud Ruols in 2017. The dating platform enables users to meet people that are looking for the same kind of relationship.

- Fruitz has become one of the fastest-growing dating apps in Europe, experiencing rapid growth across France, Belgium, Netherlands, Switzerland, Spain, and Canada.

- The dating app is particularly popular with Gen Z, a growing segment of online dating consumers.

- The French app encourages open and honest communication of dating intentions through four playful fruit metaphors – cherries, grapes, watermelons, and peaches. Similar to both Bumble and Badoo, it is a freemium app.

Fruitz x Bumble: Deal Rationale

- Bumble Inc. [NASDAQ:BMBL] operates online dating and social networking platforms in North America, Latin America, Europe, Russia and Australia. Its main applications are Bumble and Badoo, which offer subscription and credit-based dating products.

- Approximately 40 million users visit on a monthly basis Bumble’s applications and the company shows revenue growth of 55% in Q2 2021 compared to Q2 2020.

- This is Bumble Inc.’s first acquisition, in support of its mission of creating a world where all relationships are healthy and equitable. Fruitz is a natural fit within Bumble Inc., complementing its existing Bumble and Badoo apps.

- With this acquisition, Bumble Inc. will strengthen its foothold in Europe as well as combine Fruitz’s dynamic Gen Z oriented product with its industry-leading machine learning, marketing, localization, and safety platforms.

Process Highlights & Clipperton’s Role

- Clipperton acted as sole sell-side financial advisor to Fruitz, its management and shareholders in this transaction and its mission consisted in supporting Fruitz to drive a compact process.

- This transaction is one of the biggest transactions in the dating application space and confirms Clipperton’s unique expertise in the consumer subscription industry after successfully advising 8fit, a digital fitness & mindfulness app, on its sale to Withings or advising a leading mindfulness platform on its sizeable financing round by several family offices.

- This deal is yet another cross-border transaction that Clipperton advised on including listed counterparts, for example advising Gastrofix on its sale to Lightspeed POS Inc. [TSX: LSPD] or Packlink on its sale to Stamps.com [NASDAQ: STMP].

- Fruitz’s CEO Julian Kabab stated: “Bumble’s vision and product have been an inspiration to us from day one. We’re so excited with the opportunity to grow as part of Bumble Inc., and work toward empowering more healthy relationships.”

- Antoine Ganancia, Partner at Clipperton, stated: “We are thrilled to have advised Fruitz in this transaction and we are convinced that Bumble will be the right partner to help Fruitz achieve its visions. This transaction is testament to Clipperton’s broad knowledge of and track-record in the consumer subscription industry.”

Deal Team

- Nicolas von Bülow, Managing Partner, nvonbulow@clipperton.com

- Antoine Ganancia, Partner, aganancia@clipperton.com

- Thomas Noslier, Associate, tnoslier@clipperton.com

- Nathan Burnel-Hauteville, Analyst, nburnel@clipperton.com

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 350 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.