Tag : News

- Clipperton acted as sole financial advisor to KERCIA Solutions, a French leader in electronic voting software and services, on its equity financing by Siparex Entrepreneurs (Rhône Alpes PME) and BNP Paribas Developpement.

- KERCIA’s new financial partners intend to support the company as it continues to expand, in particular through an external growth strategy and in structuring its finance and ESG functions.

Our Client

- Co-founded in 2007 by Fabrice Fernandez and Yann David, and based in Meylan (Isère – France), KERCIA develops secure multi-channel voting solutions (internet, smartphone, paper, etc.) for companies, public bodies (local authorities, schools, universities, etc.) and associations.

- KERCIA’s offering is mainly based on proprietary voting software for elections within large companies, operated in service mode by a project manager. The company has also recently developed a new 100% autonomous self-service solution for SMEs with fewer than 125 employees.

- In 2020, the 2 co-founding directors joined forces with Victor Granger, who became Managing Director in charge of Development. KERCIA now serves a portfolio of over 5,000 customers, mainly through direct sales, but also aims to forge strategic partnerships with accountancy firms and HR, software vendors. Today, the company employs 70 staff in 2 locations in France.

- KERCIA is positioned in a buoyant market with e-voting saving employers and their HR departments time, simplifying procedures, ensuring greater reliability, and boosting voter turnout. As a result, the company has seen strong growth since 2016, driven in particular by new regulations favorable to electronic voting, especially for CSE elections.

Deal Rationale

- KERCIA welcomes Siparex Entrepreneurs (Rhône Alpes PME) and BNP Paribas Développement as minority shareholders in a primary transaction that also gives four key managers a stake in the company. KERCIA’s new financial partners intend to support the company as it continues to expand, with the ambition of putting ESG issues at the heart of its strategy, KERCIA, supported by the Siparex Operating Team, wishes to develop and structure its CSR approach.

- Fabrice Fernandez, Yann David, and Victor Granger, stated: “We are delighted to welcome Siparex Entrepreneurs and BNP Paribas Développement to KERCIA’s capital. This is an important milestone that validates all the work carried out to date by all the KERCIA teams and is fully in line with our development plan. Our two new partners will help us to accelerate our growth and achieve our objectives.”

- According to Julien Dupuy, Partner Siparex Entrepreneurs (Rhône Alpes PME), “We are pleased to be supporting KERCIA in this new phase of its growth. Led by a well-balanced and complementary management trio, and positioned in a buoyant sector with a relevant offering, KERCIA has everything it takes to become the leader in electronic voting in France.”

Clipperton’s solid track record in HR tech

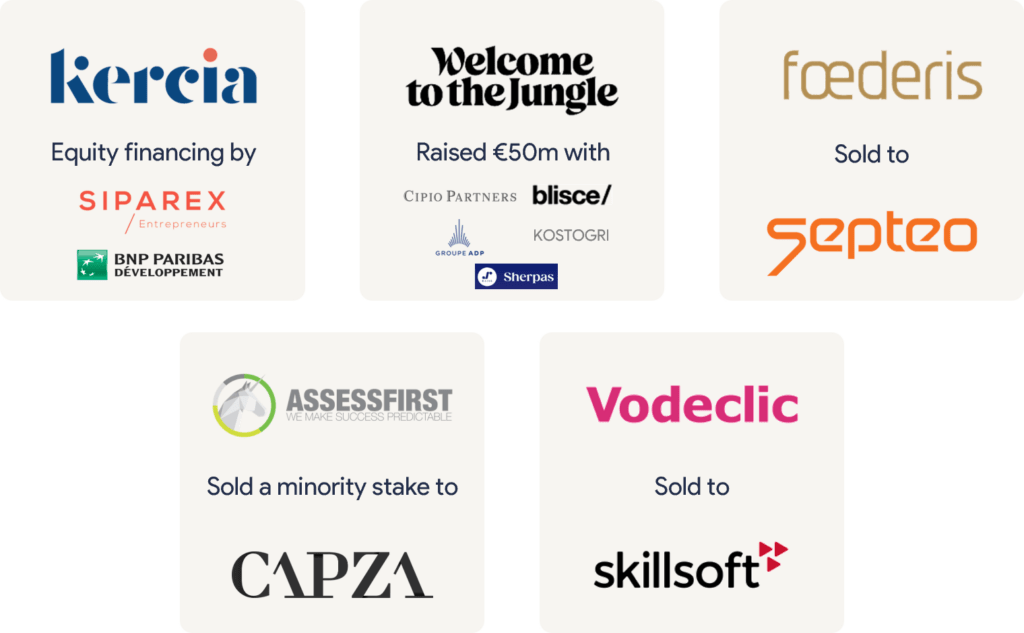

- This transaction is testimony to Clipperton’s know-how in advising HR tech pioneers, with credentials such as Welcome to the Jungle’s €50m Series C, Foederis Group’s sale to Septeo, AssessFirst’s growth investment from CAPZA or Vodeclic’s sale to Skillsoft.

Deal Team

- Thibaut Revel, Managing Partner

- Wael Abou Karam, Vice President

- Anne-Sophie Luo, Associate

- Clara Lamotte, Analyst

Read the French press release here.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.