Clipperton is a leading technology advisory boutique supporting fast-growing companies and founders in their strategic transactions (M&A and Private Placements). We therefore have a privileged vantage point on the transformative trends in technology.

The following analysis is based on a list of 650+ European companies that we have identified as healthtech startups (see methodology at the end of the article)

Granted, it took a while. But the European ecosystem seems finally ripe for transformation and ready to attract VC money

Healthcare has long been lagging behind when it comes to implementing digital strategies. High levels of regulation, local barriers to entry and persistent reluctance to change did not help. But one could sense digitization would ultimately leave no healthcare area untouched. As an advisor exclusively focused on technology, we felt the tide turning when we saw generalist VCs significantly raise their interest in healthcare, while they used to shy away from the segment.We now see both specialists and generalist VCs heavily pouring euros in European healthtech. No room for doubt, this will perdure in the foreseeable future; especially at a time when the coronavirus has brutally revealed the urgent need for a modernization of the medical environment and a widespread use of digital in healthcare.

Doctolib, Babylon Health, Kry, Alan, etc: startups digitizing the relationship between patients and health providers were the prom queens of the last decade (spoiler: this is going to change 😊)

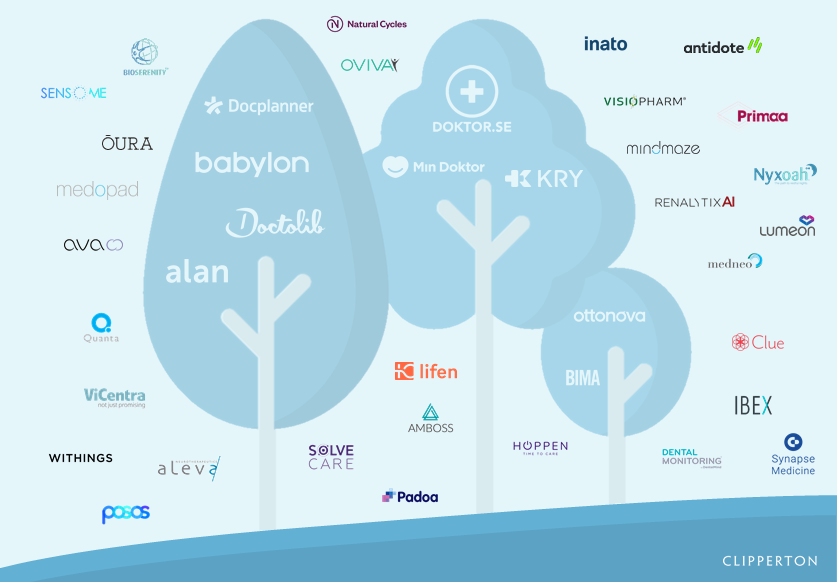

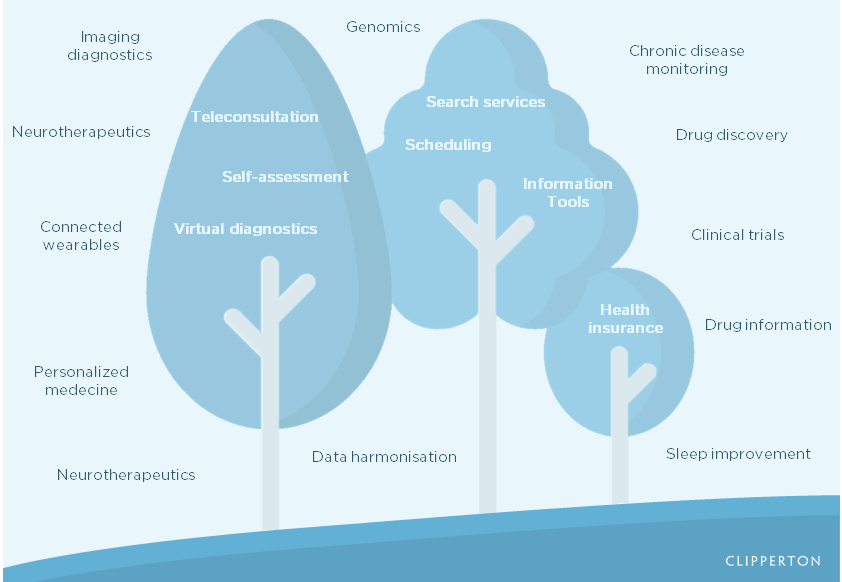

Telehealth, health insurance or appointment services hit the headlines with heavily funded players, those we call “Sequoias”

Telehealth, health insurance or appointment services hit the headlines with heavily funded players, those we call “Sequoias”Telehealth, health insurance or appointment services were the most trending topics of the last decade and the startups focusing on those topics grabbed the lion’s share of the VC money (and public attention), driven by local champions. Ask around on the European streets, good luck finding someone who did not get wind of Doctolib, Babylon, Docplanner or Kry. These “Sequoias” were able to lay the first — and very visible — stones of healthcare digitization by releasing pressure on the main pain points along the patient’s medical journey.

The Data Game: behind these healthtech media darlings (our “Sequoias”), a rising wave of new startups focused on creating, collecting and leveraging patient data

What’s coming next?

As tech experts, we have always placed a lot of importance on data. Whatever the verticals, the “data-master” who managed to own, manipulate and extract value from data are those who are likely to succeed in the long run. We never thought that healthcare would be any different.Our last deals in the space — Withings and Ibex — differed from above mentioned “Sequoias” with a radically more data-centric health approach. Withings stands out as the world pioneer in the home-based data collection space thanks to its unmatched ability to collect and process billions of data points and active them to deliver valuable insights. Ibex pioneered the AI-based cancer diagnosis by identifying the early signs of a prostate cancer (world premiere) that practitioners had not been able to detect through traditional diagnosis methods. Overall, our health dealflow is increasingly geared towards companies dealing with patient data, in one way or another. We wanted to dig further to see whether this was true at European scale.To do so, we divided our list of 650+ European healthtech startups between what we called “data-centric” players and the others:

“Data-centric” = digital players primarily focused on producing, collecting, activating, digitizing, managing or exploiting patient data through AI-enabled tools.

Alan, for instance, puts a lot of efforts into automated document processing, but we consider that its primary activity is not fully data-centric, while Withings’ or Ibex’s definitely are. The concept of “data-centric” being by nature subjective, the classification was obviously complex and often subject to debate. But eventually, the figures we obtained confirmed initial thoughts. The recent massive surge in patient data clearly triggered the emergence of new entrants willing to leverage this data.

Proof in numbers:

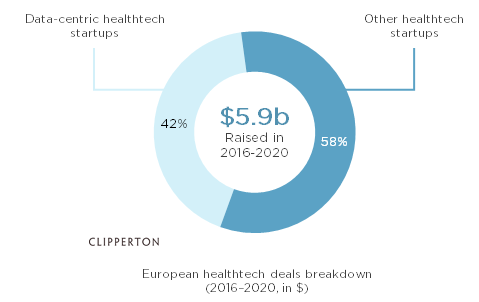

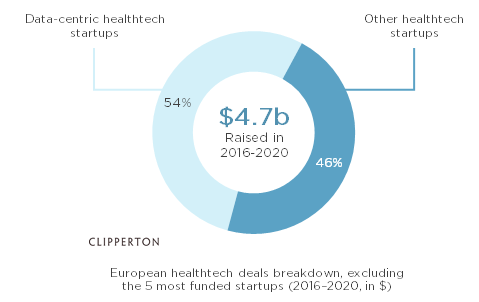

Data-centric healthtech grabs 57% of the deals but only 42% of the money

Based on fundraising data from the healthtech startups we identified, we observed that data-centric healthtech startups captured 57% of the 1,200+ funding rounds but only 42% of the $5.9b invested in the space in the last 5 years.

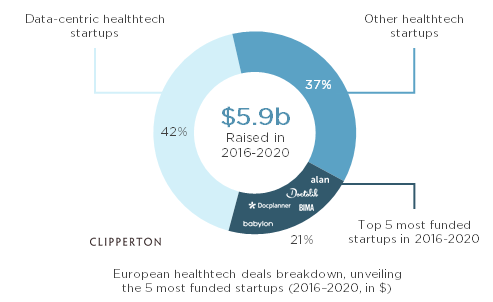

“Sequoias” (Babylon, Alan, Bima, Docplanner and Doctolib) capture more than 20% of the money

A closer look reveals that the 5 most funded companies during the period concentrated 21% of the money invested. Not surprisingly, the top 5 companies focus on digitizing the relationship with patients: telehealth, health insurance and appointment services.

Data-centric healthtech startups are now gulping over 50% the VC money flowing to healthtech companies in Europe

Excluding the “Sequoias”, data-centric healthtech grabs 54% of the money left

If we look at the figures disregarding the top 5, we see data-centric healthtech startups are now gulping over 50% the VC money flowing to healthtech companies in Europe (top 5 captured $1.2b, excluding them leaves us with $4.7b).This evidences that behind the mega-rounds captured by telehealth or services, a myriad of new entrants focused on patient data is embarking growth, laying the ground for a (more) radical transformation of our healthcare systems.

We have identified three layers in this data-centric trend, with a common obsession: unleash the value of patient data

● The “Ants”: how can we aggregate more data from the patient? The combination of real-time connectivity and sensing technologies enables the capture of an infinite amount of data that previously did not exist (ECG, weight, sleep data,etc.);

(i) An example? Withings leverages a proprietary portfolio of advanced medical devices (scales, trackers, blood pressure monitors…) to collect and monitor health parameters in a continuous, non-invasive and accurate manner.

(ii) Who else is in there? Bioserenity, Oura Health, Ava, Sensome, etc.

● The “Bees”: how can we recover entrenched and fragmented data? A lot of patient data is available but it historically suffered from a lack of interoperability. Some have grasped the problem: by unifying data formats, they free health stakeholders from siloed manual processes and thus encourage interoperability at scale;

(i) Example: Causaly enables to find evidence to answer complex medical questions within seconds thanks to a cutting-edge AI platform integrating more than 30 million biomedical publications.

(ii) Players sample: Lifen, Synapse Medicine, Posos, Amboss, etc.

● The “Butterflies”: how can we leverage data to improve patient health? AI-enabled technologies are a hot topic in health, but their use at scale remains constrained so far! The main challenge for new entrants is to efficiently exploit the capabilities offered by the combination of data uniformization and advances in AI to drive significant improvement in care and patient management.

(i) Example: Antidote.me is transforming clinical trials by matching millions of patient data with medical researchers needs, helping them find the right patients for the right clinical trials and speed up the development of new treatments.

(ii) Players sample: Inato, Ibex, Azmed, Aiforia, etc.New use cases now emerge daily. Image recognition revolutionizes diagnostics. Deep learning empowers pharmatech companies to design new drugs. AI-based algorithms exploit large data sets collected from wearables to monitor treatments in real-time. Etc.

What’s ahead of us?

The digital wave laid the first — and very visible — stones of healthcare transformation. We have no doubt that the AI wave will reshape the medical field with even greater force

● We see massive market opportunities on verticals dealing with patient data but few role models have emerged so far. Players that will manage to break healthcare integration barriers and scale at a global level will have a clear path to become billion-dollar companies;

● Healthtech data will enable a completely different medical approach from a curative to a more predictive, preventive and personalized approach;

● Going further and based on what happened in other sectors after unlocking massive access to data (advertising is an example), we expect a complexification of the value chain built around patient data. The sector maturation and the multiplication of new entrants may give birth to new branches: data privacy, health data management platforms, etc.

Scope & Methodology

All quantitative analysis are based on a database of 650+ European startups identified by Clipperton as healthtech players. The concept of healthtech being complex, we have deliberately established criteria, based on our scope in healthcare, to build a consistent database:● Healthcare startups using technology / software / digital as a key differentiator versus traditional healthcare companies;● No biotech, no pure medical devices (we only considered tech-enabled medical devices);● Headquartered in Europe and raised >$1m.

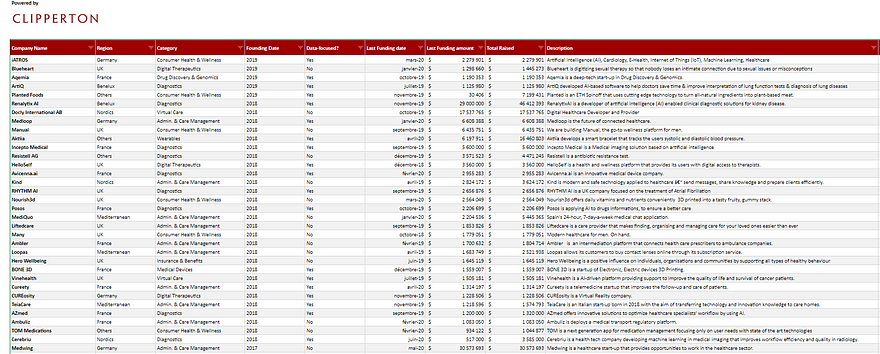

Interested by our European healthtech base?

We are pleased to give you access to our database of European healthtech startups. You can access the spreadsheet by filling out a quick form.

If you believe we missed some players in this field, do not hesitate to contact us to add new names within this database.

Interested to know more/discuss about our healthtech analysis and our track record in the space?

Please contact our team dedicated to healthtech:

…or reach out at healthtech@clipperton.net