Clipperton is pleased to provide an extensive review of the 2021 Cybersecurity transactional landscape.

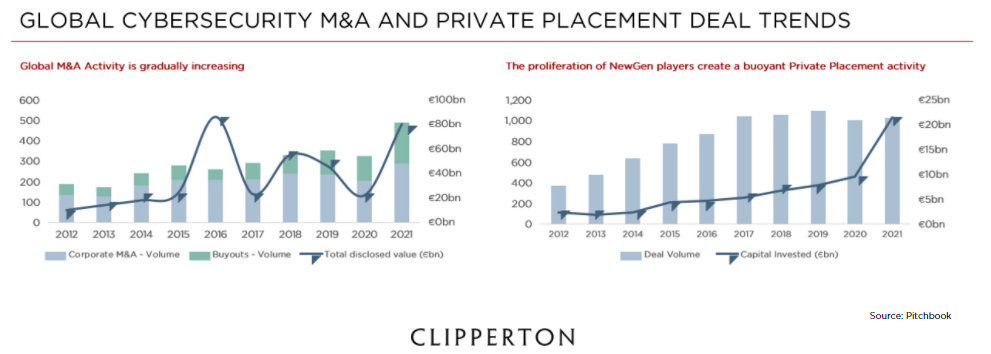

In 2021, the cybersecurity landscape has been marked by significant transactional activity, benefiting from strong COVID-19 tailwinds, and an acceleration of the transformation of corporate IT infrastructures.

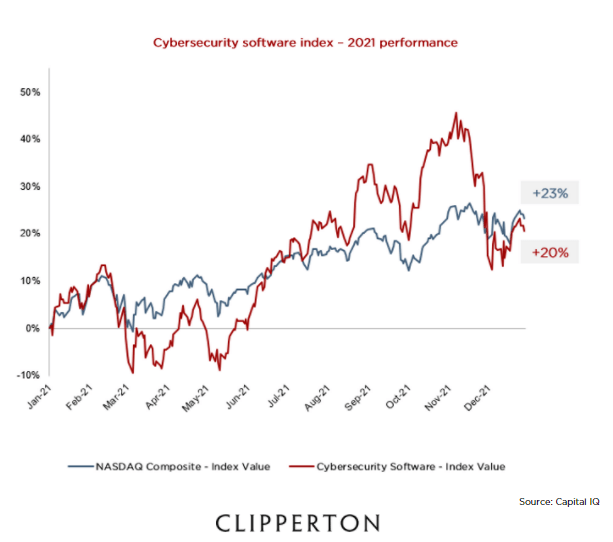

By the end of 2021, Clipperton’s cybersecurity software index has closed at +20% vs 2020. The stock market performance of listed cybersecurity companies had been outpacing NASDAQ until October 2021, when an end of year correction severely impacted cybersecurity SaaS “star stocks”.

2021 also proved to be the year of large take-privates of cyber software vendors, involving tier-1 private equity investors such as Thoma Bravo and Permira (acquisitions of Proofpoint, Mimecast and McAfee, among others).

In this context, the European cybersecurity ecosystem is starting to catch up. A new generation of European cybersecurity software vendors are now competing on local markets with US and Israeli leaders, leading to an increased financing and M&A activity.

In this research paper, Clipperton’s team has zoomed into the cybersecurity landscape from a dealmaking perspective with a European focus, and shares its views on the following topics:

- Market overview and valuation:

- Clipperton Cybersecurity Index 2021;

- Key cybersecurity IPOs in 2021;

- Selected take private transactions;

- Recent transaction activity and trends in Europe and Israel:

- Selected private placement transactions;

- Selected M&A transactions.

To access the PDF report, please fill out the form below.

Cybersecurity team: feel free to reach out to discuss these insights.

- Thibaut Revel, Managing Partner

- Olivier Combaudou, Executive Director

- Wael Abou Karam, Associate

- Elie Hodara, Analyst

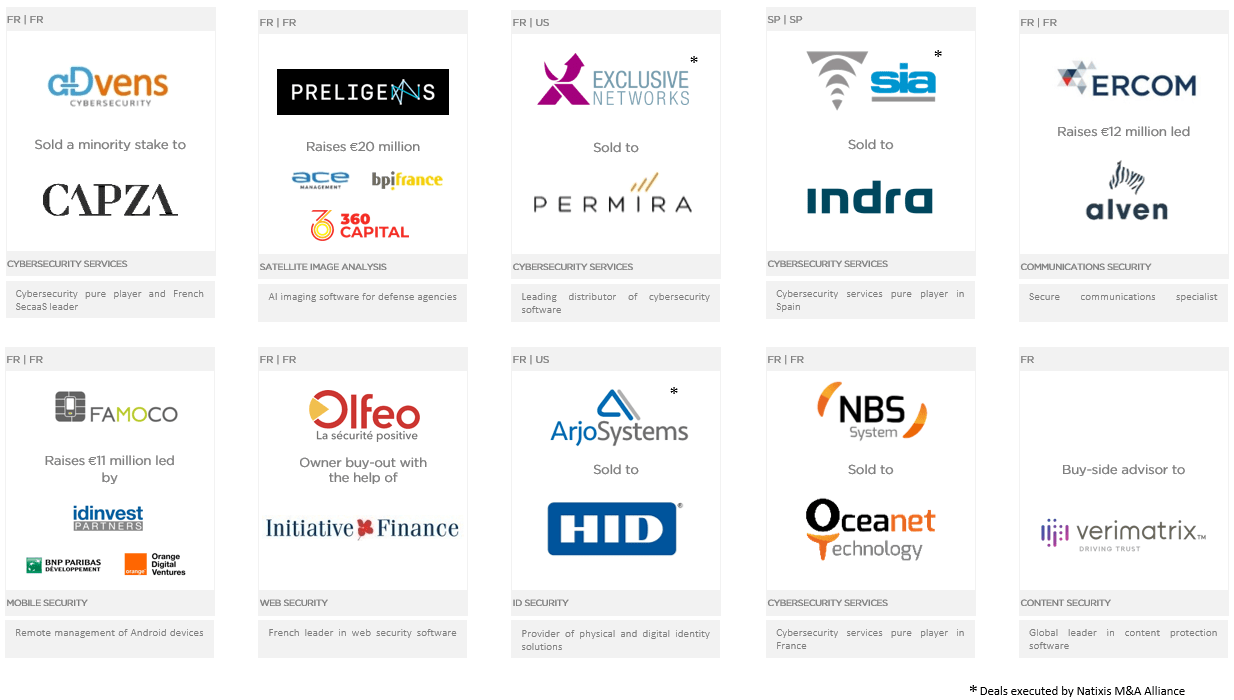

Selected track record in Cybersecurity