- Clipperton acted as the sole financial advisor to the shareholders of Stereolabs, the global pioneer in AI vision and perception solutions, in the context of its sale to Ouster, Inc., a leader in sensing and perception for Physical AI [NASDAQ: OUST].

- With this acquisition, Ouster now offers Physical AI’s first unified sensing and perception platform, combining high-performance digital lidar, cameras, AI compute, sensor fusion and perception software, and cutting-edge AI models.

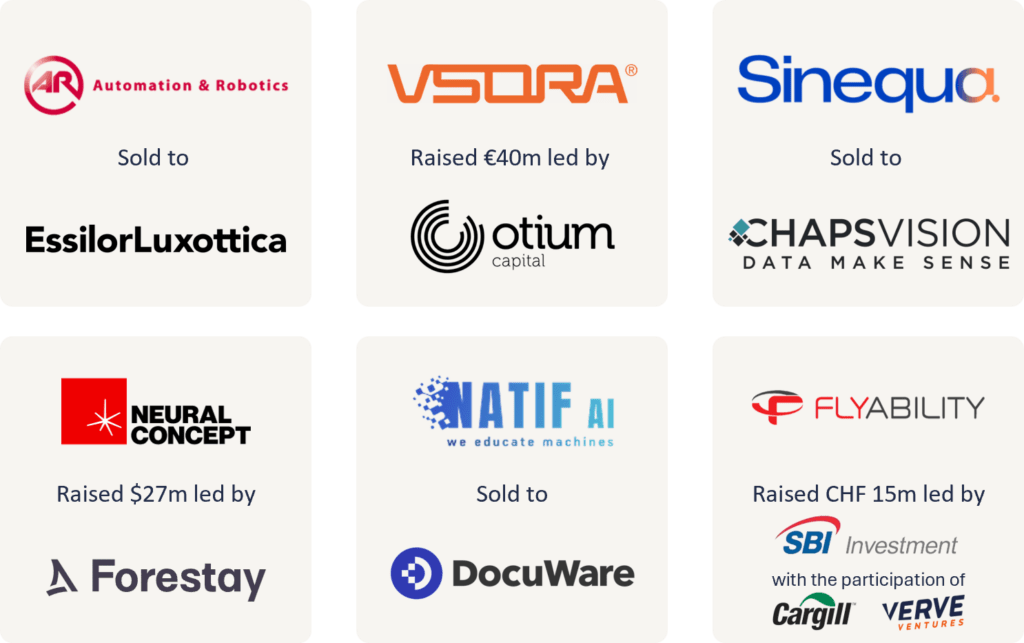

- This transaction is another milestone in Clipperton’s long-standing track record of advising enablers of the Physical AI revolution, with previous transactions including Automation & Robotics’s sale to EssilorLuxottica, VSORA’s €40m Series B round, or Neural Concept’s $27m fundraise led by Forestay.

Our Client

- Founded in 2010 by Cécile Schmollgruber, Edwin Azzam and Olivier Braun, StereoLabs provides high-quality 3D vision for advanced perception systems, developing advanced 3D perception technologies that enable machines to see, understand, and interact with the physical world in real time.

- Through its proprietary ZED stereo camera platform and software ecosystem, Stereolabs delivers high-performance depth sensing, positional tracking, and 3D mapping solutions used across robotics, autonomous systems, smart infrastructure, and industrial automation.

- With presence in France and the US, StereoLabs sells its technology on a global scale and is trusted by a growing community of developers, researchers, and enterprises, supporting deployments in both commercial and research environments and continuing to drive innovation in next-generation autonomous and intelligent systems.

- Co-founders Cecile Schmollgruber, Edwin Azzam, and Olivier Braun will continue to lead the StereoLabs team with the support of Ouster who commits to maintaining continuity for StereoLabs’ products, global customer base, and developer community.

Deal Rationale

- The transaction positions Ouster as the foundational, end-to-end sensing and perception platform for Physical AI. This platform integrates high-performance digital lidar, cameras, AI compute, sensor fusion and perception software, and advanced AI models.

- With this acquisition Ouster fuses industrial-grade Ouster digital lidar with StereoLabs ZED cameras to deliver seamlessly synchronized and calibrated data out-of-the-box; combines high-density stereo camera data with the range and accuracy of lidar data to optimize object manipulation, safety, and navigation; and simplifies customer development while reducing costs with best-in-class customer support from prototype to production.

- On top of strengthening Ouster’s software capabilities, the deal significantly increases total addressable market across the robotics, industrial, and smart infrastructure verticals through new vision and AI compute solutions; unlocks new high-growth use-cases for humanoid robotics, industrial automation, and visual inspection; and leverages a complete suite of technologies to provide additional value to customers.

- “The future of autonomy is not about choosing between vision or lidar, it’s about unifying them,” said StereoLabs CEO Cecile Schmollgruber. “By combining StereoLabs’ AI vision with Ouster’s digital lidar, we are creating the world’s most capable perception platform to directly address customers’ primary sensor fusion requirements and enable machines to sense, think, act, and learn in the physical world.“

Clipperton’s track record in advising deep tech industry disruptors

This transaction is another milestone in Clipperton’s long-standing track record of advising deep tech innovators, with previous transactions including Automation & Robotics’s sale to EssilorLuxottica, VSORA’s €40m investment, and Neural Concept’s $27m fundraise led by Forestay.

Deal Team

- Nicolas von Bülow, Managing Partner

- Martin Vielle, Partner

- Arthur de Lembeye, Vice President

- Camille Servant, Analyst

About Clipperton

Clipperton is a leading international investment bank dedicated to technology and growth companies, with offices in Paris, New York, Berlin, and Munich, as well as partnerships in the Netherlands, the UK, Switzerland, China, Italy, and Spain. We provide strategic and financial advisory services to entrepreneurs, corporates, and top-tier investors looking to execute strategic M&A, private equity, private placements, and debt financing transactions. Founded in 2003, we have completed over 500 deals with fast-growing technology businesses, blue-chip corporates, and renowned financial investors.