- Clipperton and Natixis Partners acted as financial advisors to the shareholders of Vade, a French leader in email cybersecurity with more than 2.5 billion messages analyzed daily. Vade is joining Hornetsecurity Group, a leading international cloud security and compliance SaaS provider headquartered in Hanover, Germany.

- This partnership aims to position the group as the preeminent cybersecurity software provider for customers and partners, who will benefit from a more extensive product offering positioning Hornetsecurity as a global reference for cloud-based cybersecurity services.

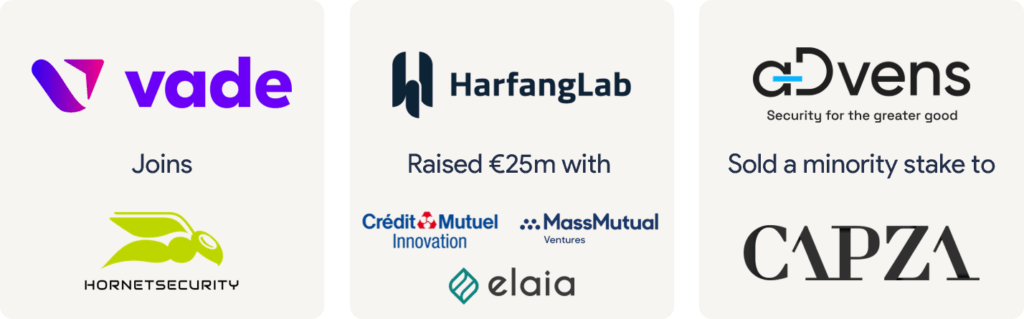

- This deal illustrates Clipperton’s increasing focus in the cybersecurity segment, following the recent transactions involving HarfangLab and Advens. This deal further marks the 13th cross-border transaction advised by Clipperton in the past 12 months.

Our Client

- Vade is a fast-growing, channel-first company that has become known for its industry-leading, SaaS-based email security offering for Microsoft 365, with differentiated API-based email filtering technology and an exceptionally efficient email security solution for large telcos and OEMs all over the world.

- Founded in 2009, Vade protects a vast number of corporate and consumer mailboxes and serves the ISP, SMB, and MSP markets with award-winning products and solutions that help increase cybersecurity and maximize IT efficiency.

Vade x Hornetsecurity: Deal Rationale

- Clipperton and Natixis Partners acted as financial advisors to ISAI Expansion and the other shareholders of Vade in this transaction.

- Hornetsecurity is a leading global provider of next-generation cloud-based security, compliance, backup, and security awareness solutions that help companies and organizations of all sizes around the world. Its flagship product, 365 Total Protection, is one of the most comprehensive cloud security solution for Microsoft 365 on the market.

- Hornetsecurity operates in more than 30 countries through its international distribution network of 8,000+ channel partners and MSPs. Its premium services are used by more than 50,000 customers.

- This transaction with Vade is in line with Hornetsecurity’s strategy of product build-up and international expansion. Backed by PSG Equity, TA Associates, and Verdane, three leading software investors, Hornetsecurity aims to establish itself as a leading international cloud security and compliance software champion.

- Georges Lotigier, CEO of Vade, said: “Since its inception, Vade has remained dedicated to introducing innovative approaches to combat cybersecurity threats. By joining Hornetsecurity, we will pursue and accelerate this commitment by helping to deliver a wider array of top-tier solutions to the ever-expanding cybersecurity market in Europe and worldwide. This union is the natural next step for Vade as we align ourselves with a like-minded European partner who shares our vision and culture.”

- Following the close of the transaction, Vade’s leadership team will assume different management positions at Hornetsecurity, and Georges Lotigier will become a member of the Hornetsecurity supervisory board.

Clipperton’s Cybersecurity track record

This deal illustrates Clipperton’s increasing focus in the cybersecurity segment, following the recent transactions involving HarfangLab and Advens.

Deal Team Clipperton

- Thibaut Revel, Managing Partner

- Olivier Combaudou, Partner

- Wael Abou Karam, Vice President

Deal Team Natixis Partners

- Nicolas Segretain, Managing Partner

- Thomas Flori, Director

- Pierre Zevaco, Vice President

- Antonin Durand, Analyst

Read the press release in French or German.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.