Tag : Corporate

In 2025, Clipperton achieved another strong year advising on more than 30 tech transactions across M&A, buy-outs, debt, and growth financings, representing approximately $2 billion in total deal value.

The firm continued its robust growth trajectory, expanded its footprint in the U.S. with the opening of an office in NYC and the addition of two new Managing Partners, and confirmed the success of its dedicated debt advisory team. As anticipated three years ago, the transition from VC to Private Equity dynamic has fully materialized and has now become the primary exit route for VC-backed tech companies – an evolution in which Clipperton is playing a leading role.

2026: A Defining Year for Tech as AI Scales and Profitability Takes Center Stage

Heading into 2026, the technology sector is characterized by improving fundamentals and a clearer investment playbook. AI has evolved from a thematic growth driver into a core capability across products, go-to-market strategies, and internal operations, materially enhancing scalability and efficiency. In this environment, investors are placing a premium on businesses that combine defensible technology, recurring revenue, and demonstrated profitability, reinforcing tech’s central role in large-cap M&A, LBO activity, and platform-driven consolidation.

These dynamics are clearly reflected in capital markets and private transactions alike. Public software valuations highlight a pronounced premium for profitable growth, with top-performing companies significantly outperforming peers & trading at higher multiples.

Simultaneously, M&A, LBO, and fundraising activities have seen a strong rebound in terms of value. This highlights the resurgence of significant, large-scale transactions and reaffirms the pivotal role of Private Equity within the tech ecosystem. As AI is increasingly integrated across products, services, and internal operations, the companies that successfully combine sustained growth with strong profitability are clearly establishing themselves as market leaders.

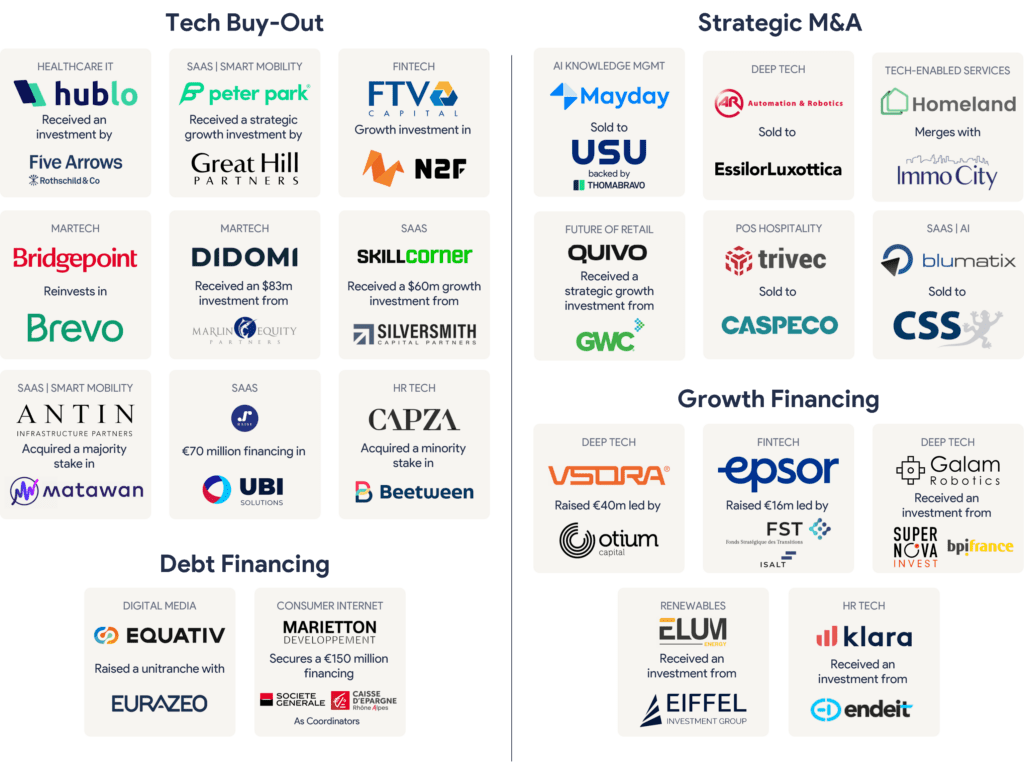

Clipperton Deal Highlights 2025

Clipperton achieved a record year in 2025 – our strongest since founding the company in 2003 – with over 30 transactions completed across Europe. This exceptional performance is driven by a clear structural trend: the increasing ambition of European tech platforms that are focused on international expansion and strategic financing.

We had the pleasure of advising leaders in their respective segments, including for example:

Tech Private Equity Deals:

- Hublo, leader in digital HR solutions for the healthcare sector, on the entry of Five Arrows via an LBO, enabling the exit of Acton Capital;

- SkillCorner, the leading provider of AI-powered sports tracking data, on its $60m growth investment from Boston-based Silversmith Capital Partners to expand in the U.S., enabling the exit of sports-focused VC fund Seventure Partners;

- Bridgepoint on the €500m financing round in Brevo, the new CRM unicorn, alongside General Atlantic and Oakley Capital (following two prior transactions in 2017 and 2020, already with Clipperton);

- Didomi, the global leader in data privacy solutions, on its $83 million investment from U.S. fund Marlin Equity Partners;

- Peter Park, the leading European provider of AI parking automation solutions, on its strategic growth investment by Great Hill Partners, bringing total funding to more than €100 million;

- FTV Capital on its strategic growth investment into N2F, a leading provider of spend management software.

Trade Sales:

- Automation & Robotics, the global leader in the design and manufacture of automated systems for optical lens quality control, on its sale to EssilorLuxottica;

- Mayday, the leading provider of AI-powered Knowledge Management in France, on its merger with USU GmbH, a global provider of software and service solutions for IT and customer service management, backed by Thoma Bravo;

- Trivec, the leading provider of POS systems in the hospitality industry, on its sale to Caspeco.

Debt Financings:

- Equativ, online advertising monetization platform, on its €200m unitranche refinancing by Eurazeo (following its 2023 LBO, also orchestrated by Clipperton);

- Marietton Development on securing debt financing from a pool of eleven banks to accelerate international expansion, support acquisitions, and reorganize its shareholders’ structure.

Growth Financings:

- VSORA, the global innovator in ultra-high performance computing, on securing a €40 million investment to bring the world’s most powerful, energy-efficient, and cost-disruptive AI chip to market;

- Epsor, a fintech specializing in employee savings and pension schemes, on raising a €16m Series C financing round led by the Fonds Stratégique des Transitions, managed by ISALT, alongside historical investors Revaia and BlackFin.

Ranked number one in France across all three types of tech transactions (fundraising, strategic M&A, LBOs), we also assert our leadership on an international level, including through our dedicated debt advisory team. Its specific expertise, particularly in ARR financing, has been leveraged for several companies such as Matawan and N2F, alongside buy-side advisory work for lead funds such as Antin and FTV Capital.

Looking Ahead

As we move into 2026, we do so with strong conviction. Building on sector expertise developed since 2003 and proven transactional execution, we are well positioned to support our clients as demand accelerates for sophisticated and innovative financing solutions. Against a backdrop of rapid technological and market transformation, we continue to leverage our deep industry insight and strategic perspective to help clients navigate complexity and capture opportunity.

We are sincerely grateful for the continued trust of our clients and the unwavering commitment of our teams, whose dedication underpins our ability to deliver impactful outcomes.

U.S. Expansion and Leadership Appointments

We have strengthened our senior leadership team and expanded cross-border:

New York Office Launch

2025 also marked a significant milestone with the opening of our New York office in September. This expansion was led by the arrival of two seasoned Managing Partners, Emily Anderson (formerly of Union Square Advisors and Goldman Sachs) and Richard Hooper (formerly of RBC, Barclays, and Lehman), and was recently further strengthened by the addition of Vice President Charlie Wheatly.

This development reflects the execution of our global strategy and materially enhances our ability to manage transatlantic processes and support clients in transactions involving U.S. investors.

Xavier Souvras appointed as Executive Director in Paris

Xavier Souvras joined the Paris office in September 2025 as Executive Director.

A seasoned corporate finance professional, Xavier Souvras brings over 10 years of experience to Clipperton, gained from previous roles at Amala Partners and DC Advisory. Throughout his career, Xavier advised mid-market clients across a range of sectors, including technology, business services, leisure & hospitality, and industrials, on a wide variety of capital transactions.

We have further welcomed 6 new talents to our team in 2025!

Other Corporate News

The Journey from Venture Capital to Private Equity – The 2025 Guide for Tech Startups

Clipperton released its paper “The Journey from VC to PE: The 2025 Guide for Tech Startups”. The report is designed to provide founders, venture capitalists, and stakeholders with actionable guidance on navigating this evolving landscape and optimizing for successful PE transactions.

Clipperton is ranked as a leading TMT advisor in M&A and Private Equity in France

We are honored to once again be recognized in the leading categories M&A (TMT, Smid-Capi, Transactions €30-€150m), PE (Growth Financing, LBO Small-Cap, Debt Advisory), and Health & Pharmaceutical Industry M&A in the Leaders League 2025 ranking.

A heartfelt thank you to our clients, partners, and friends for your continued trust, and to our entire team for their exceptional dedication and expertise.

A Roadmap for Europe’s Tech Future

At Clipperton, we believe Europe must take bold action to secure its place in the next wave of technological innovation.

Our co-founders, Nicolas von Bülow and Stéphane Valorge, outline a roadmap for Europe to build its own foundational tech infrastructure – from cloud platforms to AI processors – and to attract the talent needed to make it happen.

Read the column here.

Empowering Our Positive Impact

At Clipperton, we take pride in our commitment to supporting key innovators in their strategic and financial growth. In the spirit of starting the New Year with impact, we made the choice to support organizations that are positively transforming the world.

Click on this link and select from three thoughtfully chosen charities. Thank you for your participation!