- Clipperton and Natixis Partners jointly acted as financial advisor to CAPZA, a leading private equity investor in European SMEs, on its minority acquisition in Travelsoft. CAPZA’s investment is made through its Flex Equity Mid-Market II fund, its fourth since May 2022.

- Thanks to CAPZA’s support, Travelsoft is poised to accelerate its worldwide expansion through external growth strategies. Simultaneously, the company will implement concrete measures to progress towards its sustainability goals and strengthen its commitment to CSR (Corporate Social Responsibility).

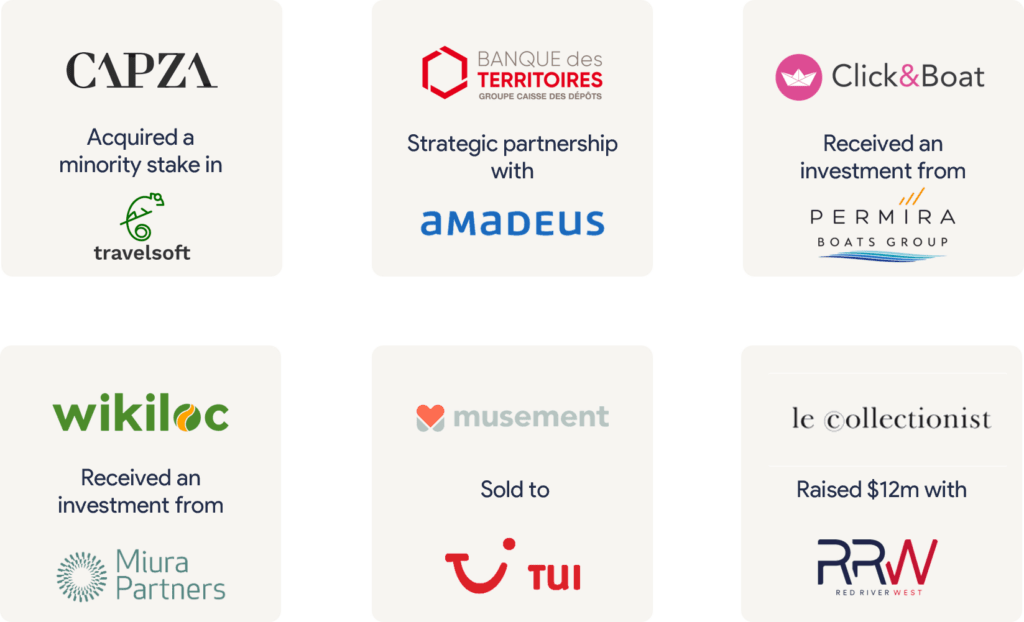

- This transaction notably reinforces Clipperton’s track record in advising on high-profile travel tech transactions, including with former clients such as Click&Boat, Tui Musement, or Le Collectionist.

About Travelsoft

- Founded in 2000 and headed by Christian Sabbagh, Travelsoft develops SaaS platforms dedicated to the tourism industry. Historically operating in France, the Group has recently expanded into Europe through external growth with the support of Andera Partners (ActoMezz fund) and other financial partners. Today, the company brings together three software platforms: Orchestra, Traffics, and TravelCompositor.

- Travelsoft automates bookings for more than €5 billion annually, via more than 300 tour operators and 600 connectivity providers in more than 40 countries, mainly in Europe and Latin America. Travelsoft has more than 200 employees who are experts in travel technology for tourism.

Deal Rationale

- CAPZA has joined the Group’s capital as a key minority shareholder, alongside Christian Sabbagh and the original founders of Traffics and Travel Compositor.

- With the support of CAPZA, Travelsoft stands as a natural consolidator of its sector on a global scale. A number of acquisition projects are already under consideration, based on geographical or functional complementarities.

- CAPZA will also support the Group in implementing concrete actions that will help meet its sustainable development objectives: contributing to the promotion of responsible tourism, reducing the Group’s carbon footprint in line with the Paris Agreements, and strengthening its CSR approach.

- “In CAPZA, we have found a partner of choice who shares our values, and who will support us in our strategy of consolidating Travel Tech Loisirs. CAPZA’s teams have an international network and real expertise in external growth operations, enabling us to envisage strategic acquisitions.” Christian Sabbagh, Founder & CEO of Travelsoft, stated.

- “As Europe’s leading provider of software platforms for travel professionals, Travelsoft’s ambition is to support the digitalisation of the industry through innovative technological solutions. We were attracted by Travelsoft’s recurring business model, the long-standing partnership it has established with its customers, its reputation for quality in its market and the long-term trends in the sector. We are proud to support Christian Sabbagh, the founders of the Group’s platforms and their teams in consolidating the Travel Tech market.” Guillaume Basquin, Partner, CAPZA Flex Equity Mid-Market, said.

Clipperton’s Travel Tech track record

- This transaction evidences Clipperton unique expertise in the travel tech space having notably successfully advised La Banque des Territoires, Click&Boat, Tui Musement, and many other businesses on their strategic transactions.

Clipperton’s 6th buyout transaction within the last 12 months

- This deal also further positions Clipperton as reference financial advisor on software buyout transactions, with a track record including Groupe Sinari (majority stake acquired by Bridgepoint), ARLETTIE (LBO with CAPZA), or Wikiloc (receiving an investment from Miura Partners).

Clipperton

- Thomas de Montille, Partner

- Nicolas von Bülow, Managing Partner

- Karim Mekouar, Vice President

- Simon Boucher, Associate

- Ismail Roqaichaoui, Analyst

Natixis Partners

- Driss Mernissi

Read the press release in French.

About Clipperton

Clipperton is a leading investment bank dedicated to technology and growth companies. We provide strategic and financial advisory to entrepreneurs, corporates, and top-tier investors in Europe willing to execute transactions such as strategic M&A, private equity transactions, and private placements. Founded in 2003 and with offices in Paris, Berlin, Munich, London, New York, and Beijing, Clipperton has completed over 400 M&A and private placement transactions with fast-growing technology start-ups, blue-chip corporates, and renowned financial investors.