Clipperton acted as sole financial advisor to the shareholders of Equativ, the online advertising monetization platform. Majority-owned by Bridgepoint following the 2023 LBO, the online advertising monetization platform refinanced its debt with Eurazeo.

Our Client & Deal Rationale

- Founded in 2001, Equativ is a leading player in the AdTech value chain, providing an ecosystem of end-to-end technology solutions and services connecting advertisers to audiences (AdServer, Supply Side Platform, Demand Side Platform).

- Equativ covers all major formats, including display, video, and audio, enabling omnichannel campaign execution on CTV and Retail Media.

- The online advertising monetization platform Equativ has grown significantly since its 2023 LBO through both organic growth and acquisitions.

- Clipperton acted as sole financial advisor to Equativ and its shareholders to refinance its existing unitranche and provide additional liquidity for future acquisitions.

Demonstrating Long-Term Client Commitment

Equativ has been a long-term client of Clipperton since 2019, with this being the 5th transaction advised involving Equativ. Previous transactions include Capital Croissance selling its majority stake in Equativ to Bridgepoint Development Capital, after an MBO in 2021, Kamino Retail’s and LiquidM’s sale to Equativ. It demonstrates Clipperton’s capacity to serve its clients as a trusted advisor in various strategic operations.

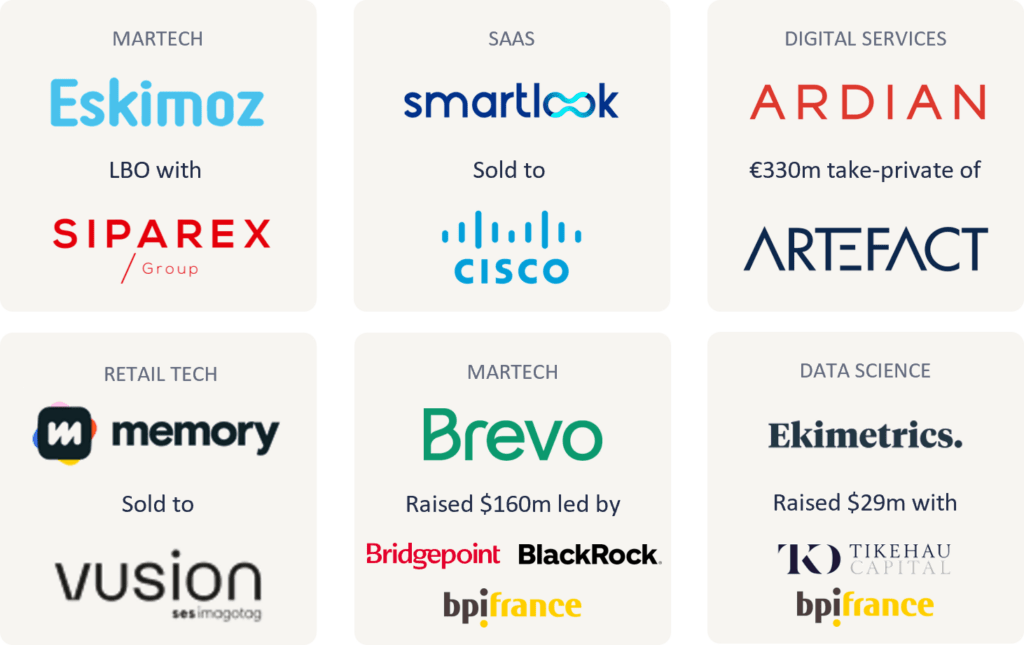

This transaction reinforces Clipperton’s rich track record in Martech & Adtech, with many recent landmark transactions such as Eskimoz’s LBO with Siparex ETI, the sale of Smartlook to Cisco [NASDAQ:CSCO], Ardian’s €330m take-private of Artefact [ALATF], In The Memory’s sale to SES-imagotag [EPA:SESL], or Brevo’s $160m Series B.

Deal Team

- Nicolas von Bülow, Managing Partner

- Laurence de Rosamel, Partner

- Marc Schäfer, Executive Director

- William Poirson, Director

- Victor le Breton, Vice President

- Capucine Viard, Associate

- Adib Alhachem, Analyst

About Clipperton

Clipperton is a leading international investment bank dedicated to technology and growth companies, with offices in Paris, New York, Berlin, and Munich, as well as partnerships in the Netherlands, the UK, Switzerland, China, Italy, and Spain. We provide strategic and financial advisory services to entrepreneurs, corporates, and top-tier investors in Europe who are looking to execute strategic M&A, private equity, private placements, and debt financing transactions. Founded in 2003, we have completed over 500 deals with fast-growing technology businesses, blue-chip corporates, and renowned financial investors.